Introduction: Understanding Loan Maturity Date

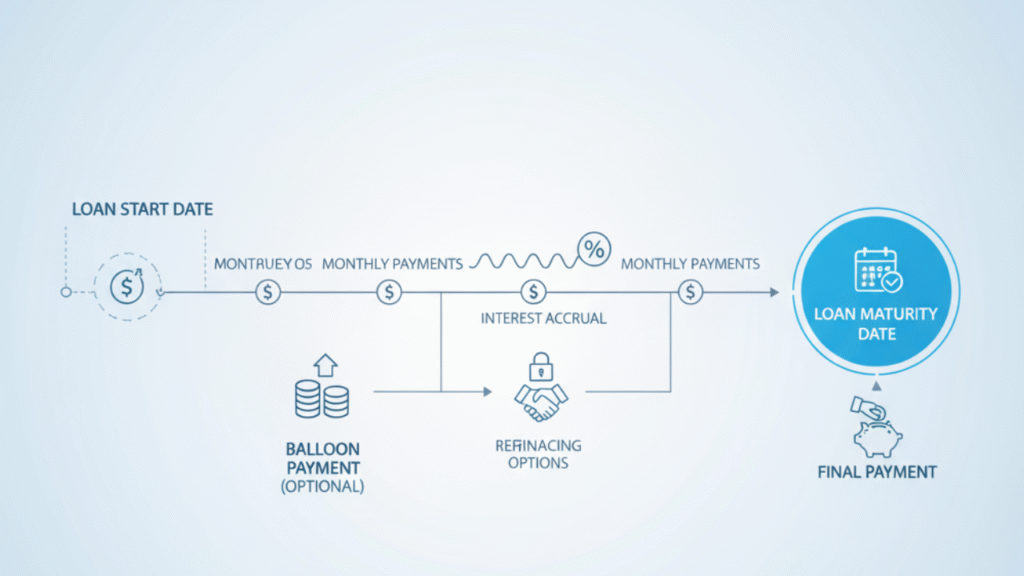

When you take out a loan, the term loan maturity date refers to the date by which the loan is due to be fully repaid. It’s a crucial concept in personal, business, and mortgage loans, as it dictates the timeline for repayment. But what exactly does the loan maturity date mean?

In this article, we’ll explain what loan maturity is, how it affects borrowers and lenders, and why understanding the maturity date is essential for anyone with a loan.

What is a Loan Maturity Date?

The loan maturity date is the date by which the borrower must repay the loan in full. This includes the principal (the amount borrowed) and any interest or additional fees that may have accrued. The loan maturity date varies depending on the type of loan, from short-term loans with a maturity of a few months to long-term loans that could span decades.

For example:

-

A 30-year mortgage has a maturity date 30 years from the loan origination.

-

A car loan may have a maturity date of 3 to 7 years.

In both cases, the loan’s final payment is made on or before the loan maturity date.

Why Is the Loan Maturity Date Important?

1. Payment Schedule

The maturity date of the loan determines the timeline for your repayments. If you have a fixed-rate mortgage, you’ll make consistent payments until the loan maturity date. For short-term loans, the maturity date often dictates how quickly you’ll need to pay back the loan in full.

2. Interest Calculations

The loan maturity date also affects how much interest you’ll pay over the life of the loan. For long-term loans, like mortgages, you may pay more in interest over time because the loan is spread out over many years.

3. Loan Refinancing

Knowing your loan maturity date can also guide decisions regarding refinancing. If you’re nearing the maturity date and still have a large balance, refinancing your loan to get a better rate or extend the loan term could be a viable option.

How Does Loan Maturity Date Work?

Fixed-Term Loan Maturity Date

Most loans, including personal loans, student loans, and mortgages, have a fixed-term maturity. These loans have a set duration, such as 5 years, 15 years, or 30 years. The borrower is required to pay off the loan by the maturity date through regular monthly payments.

For example, if you take out a mortgage loan with a maturity date of 30 years, the lender will expect you to make payments based on an amortization schedule. The final payment on the 30th year marks the end of the loan, with the balance fully paid off.

Balloon Loan Maturity Date

A balloon loan is a loan where the borrower makes smaller monthly payments that cover the interest, but the principal balance isn’t paid off until the maturity date. The borrower will owe a large lump sum (known as a balloon payment) at the loan maturity date.

For example, a 5-year balloon mortgage may require monthly payments as if the loan were amortized over 30 years, but the final balloon payment due at the end of the 5 years would pay off the remaining balance.

Callable Loan Maturity Date

Some loans are callable, meaning the lender has the option to demand repayment before the maturity date. This is typically the case for corporate loans or commercial real estate loans, where the lender may choose to call the loan based on the borrower’s financial performance.

What Happens If a Loan is Not Paid by the Maturity Date?

Failing to make the final payment by the loan maturity date can have serious consequences. Here’s what could happen:

-

Late Fees and Penalties: The borrower may be charged a late fee if the final payment is missed.

-

Default: If the loan is not paid off by the maturity date, the borrower may be considered in default, which could lead to collection actions or foreclosure (in the case of mortgages).

-

Refinancing: If you’re unable to pay the loan in full at maturity, refinancing may be an option to extend the loan term or get a lower payment.

What Is the Maturity Date of a Loan?

The maturity date of a loan depends on the loan’s type and terms. For example:

-

A car loan may have a maturity date of 3-7 years, at which time the loan balance must be paid off.

-

A home mortgage typically has a 30-year maturity, but can also be a 15-year maturity depending on the loan type.

The maturity date essentially marks the point at which the borrower is expected to have fully repaid the loan. If the loan is paid off earlier, the borrower may save on interest, but if it’s not paid off by maturity, it could lead to penalties and damaged credit.

Common Loan Maturity Date Mistakes

1. Ignoring the Balloon Payment

Borrowers with balloon loans should be aware of the large lump sum payment due at maturity. Failing to plan for this large payment can lead to financial distress.

2. Not Preparing for the Maturity Date

It’s essential to start planning for the maturity date early. Whether it’s refinancing, selling the asset, or simply making the final payment, proper planning can help avoid last-minute stress.

How to Calculate Loan Maturity Date

To calculate your loan maturity date, you need to know:

-

The start date of the loan

-

The loan term (e.g., 5 years, 10 years, etc.)

-

The payment frequency (monthly, annually, etc.)

Once these factors are determined, you can calculate the exact maturity date by adding the loan term to the start date.

For a loan maturity date calculator, various online tools can automatically calculate your loan’s maturity based on your loan balance, interest rate, and payment schedule.

Conclusion: Why Loan Maturity Date Matters

Understanding the loan maturity date is crucial for financial planning, loan management, and avoiding late fees. By knowing when your loan will mature, you can plan your repayments, make informed decisions about refinancing, and avoid the risk of default. Always ensure you’re aware of your loan maturity date to stay on top of your financial obligations.

If you’re unsure about your loan maturity date or need help planning for repayment, consider speaking with a financial advisor to ensure a smooth path toward loan completion.

Disclaimer:

The information provided in this article is for educational purposes only. Always consult a financial professional for advice on managing loans, refinances, or repayment strategies.