HSBC Mortgage Calculator

Are you wondering how much you can borrow from HSBC for your mortgage? With HSBC’s easy-to-use mortgage calculator, you can get a quick estimate of your borrowing capacity in just a few minutes.

This article will guide you through how the HSBC Mortgage Calculator works, the factors that impact your borrowing power, and why it’s essential for potential homebuyers.

What is the HSBC Mortgage Calculator?

The HSBC Mortgage Calculator is an online tool designed to help prospective homebuyers understand how much they may be able to borrow based on their financial situation. It provides an instant estimate of your borrowing potential, making it an invaluable resource for anyone considering a mortgage with HSBC.

Whether you’re buying your first home or refinancing, knowing how much you can borrow is one of the first steps in your journey. The calculator takes into account your income, existing debts, loan term, and other financial factors to give you an estimated loan amount.

How Much Can I Borrow Mortgage Calculator HSBC?

The HSBC mortgage calculator can estimate the loan amount you’re eligible for. However, it’s important to remember that it’s just an estimate. For a precise figure, you’ll need to speak directly with an HSBC mortgage advisor, who will consider your full financial profile.

How Does the HSBC Mortgage Calculator Work?

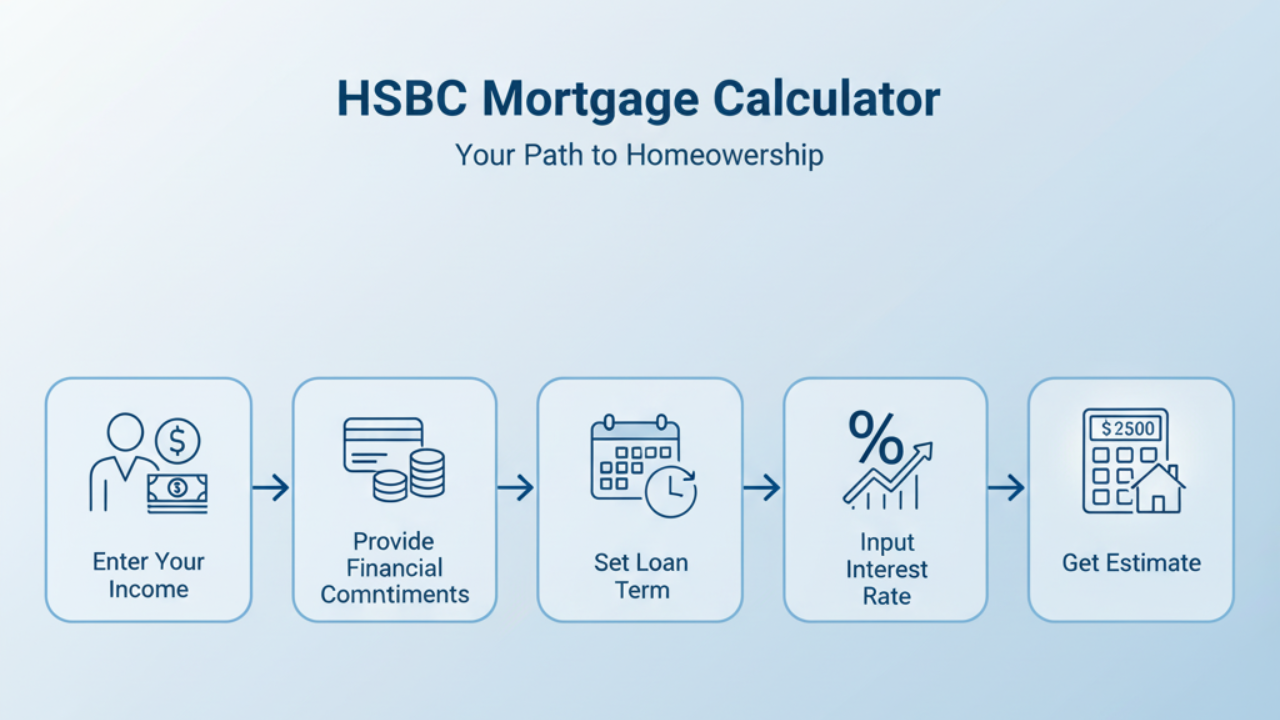

Using the HSBC mortgage calculator is simple and takes just a few steps. Here’s how you can quickly get your borrowing estimate:

-

Enter Your Income: The calculator requires you to input your gross annual income. This will give HSBC an idea of your ability to repay the loan.

-

Provide Your Financial Commitments: Include any ongoing debts such as credit card payments, personal loans, or existing mortgages. This helps HSBC assess your debt-to-income ratio.

-

Set the Loan Term: Choose the mortgage term that works best for you. Typically, loan terms range from 10 to 30 years.

-

Input the Interest Rate: You can either use HSBC’s default interest rate or input a personalized rate if you have one in mind.

-

Get Your Estimate: After entering these details, the calculator will give you an estimate of how much you could borrow.

HSBC Mortgage Calculator: How Much Can I Borrow: A Simple Example

Imagine you earn £50,000 annually, have no other debts, and are looking for a 25-year mortgage term. By inputting these details into the calculator, you’ll get an estimated loan amount based on HSBC’s lending criteria.

Factors That Affect Your Borrowing Capacity with HSBC

While the HSBC mortgage calculator is a helpful starting point, several factors can influence the actual loan amount you qualify for. These include:

1. Credit Score

Your credit score plays a significant role in how much you can borrow. HSBC will assess your creditworthiness to determine whether you’re eligible for the loan and what interest rate you’ll be offered. A higher score usually results in more favorable borrowing terms.

2. Income and Employment Status

HSBC will assess your income to determine your ability to repay the mortgage. They’ll also consider the stability of your employment. If you’re employed full-time, self-employed, or have multiple sources of income, these will all impact your borrowing capacity.

3. Existing Debts

Your debt-to-income ratio is an important factor. If you have significant monthly debts, such as credit card payments or other loans, HSBC will factor these in when determining your mortgage eligibility. The less debt you have, the more you may be able to borrow.

4. Deposit Amount

A larger deposit (down payment) can significantly increase your chances of securing a higher loan amount. HSBC typically requires at least a 10% deposit, but a larger deposit reduces the amount you need to borrow and may qualify you for a better interest rate.

5. Loan Term

The loan term you select also affects how much you can borrow. A longer loan term means lower monthly repayments, making it possible to borrow a larger amount. However, keep in mind that the total interest paid will be higher over time.

Benefits of Using the HSBC Mortgage Calculator

The HSBC mortgage calculator is a great tool for anyone looking to understand their borrowing capacity. Here are a few reasons why it’s worth using:

1. Quick and Convenient

The calculator gives you an instant estimate of how much you can borrow, making it much faster than having to manually calculate everything or wait for a bank advisor’s input.

2. Plan Your Finances

By using the calculator, you can get a clearer idea of how much you can afford to borrow, which helps you plan your home purchase or refinancing process more effectively.

3. Transparent and Simple

HSBC’s tool is user-friendly, making it easy for first-time buyers to understand their borrowing options without needing to dive into complicated financial calculations.

4. Confidence for Decision-Making

Once you know how much you can borrow, you can make more informed decisions about the homes you can afford and how much you’ll need to save for a deposit.

Common Questions About the HSBC Mortgage Calculator

Here are some frequently asked questions about the HSBC mortgage calculator:

1. Does the HSBC Calculator Consider All Expenses?

The calculator takes into account your income and existing financial commitments. However, it doesn’t factor in other living expenses, such as groceries, utilities, or lifestyle costs. It’s a rough estimate, so consider additional costs when planning your mortgage.

2. Can I Get a More Accurate Estimate by Speaking to an Advisor?

Yes. While the mortgage calculator gives a great starting point, HSBC will assess your full financial situation in person or over the phone to provide a more accurate estimate.

3. How Often is the Calculator Updated?

The HSBC mortgage calculator is updated regularly to reflect changes in interest rates, government policies, and economic conditions. However, the estimates it provides are based on the current information available.

Conclusion

Using the HSBC mortgage calculator is a smart first step in understanding your borrowing capacity. By entering your financial details, you can get a quick estimate of how much you could potentially borrow, helping you make more informed decisions about your mortgage.